- Fri. Apr 26th, 2024

Latest Post

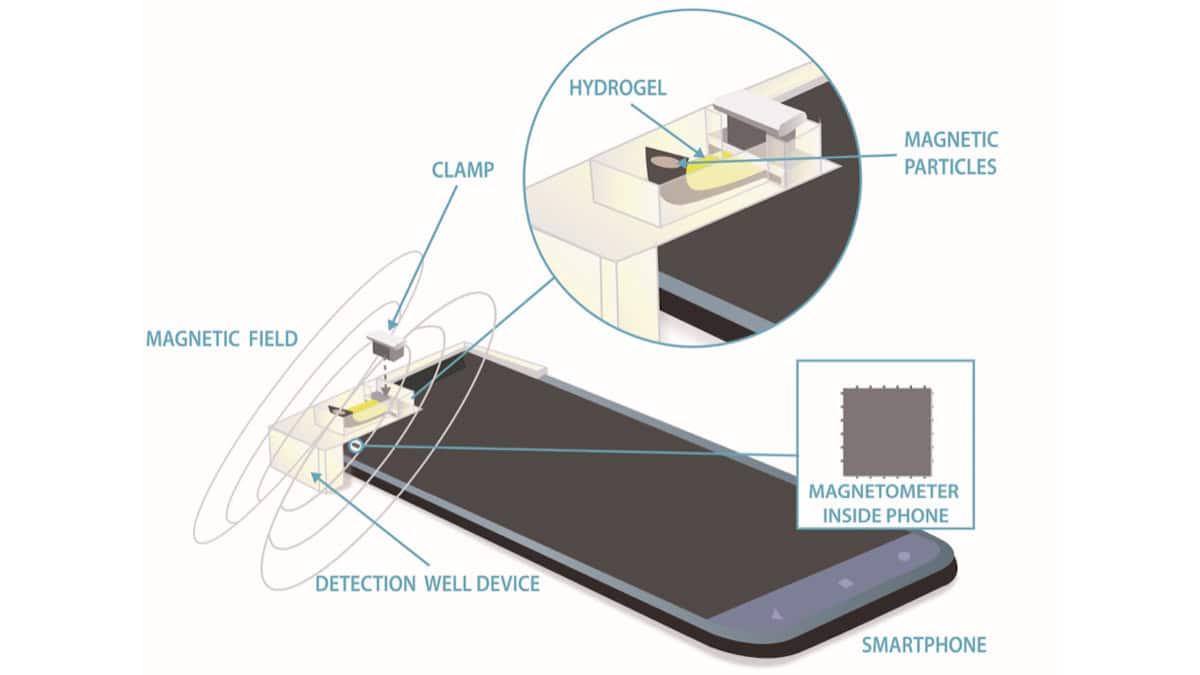

Revolutionizing Analyte Detection: NIST’s Magnetics-Based Sensor Shows Promising Results

NIST researchers have successfully developed a magnetics-based analyte sensor that has shown promising results in detecting substances. This sensor is based on the principles of magnetism and can accurately identify…

Breaking the Barriers: NAMIWalks Encourages San Diego Residents to Join the Fight for Mental Wellness

The National Alliance on Mental Illness (NAMI) invites San Diego residents to join its annual NAMI Walks and Mental Wellness Expo happening on Saturday, April 27, 2024. The event is…

Hooliganism on the Highways: The Tragic Disruption of Yerevan-Yeraskh Highway Traffic and the Urgent Need for Justice

On April 24, criminal proceedings were initiated in connection with the disruption of traffic on the Yerevan-Yeraskh highway using burning tires. According to reports from the Investigative Committee, this incident…

Unraveling the Trauma of Gun Violence: Seeking Professional Help from Horizon Behavioral Health

Gun violence is a growing concern in the region, with shootings occurring in public places such as Waffle Houses and apartment complexes. These traumatic events can have a lasting impact…

From Weinstein to Crypto: America’s Judicial System and the Digital Currency Landscape

The recent decision to overturn Harvey Weinstein’s rape conviction by a majority of four to three judges has sparked a new and painful chapter in America’s reckoning with inappropriate sexual…

Walking Towards Mental Wellness: San Diego’s NAMI Walks and Mental Wellness Expo Encourages Community Action

San Diego residents are encouraged to take part in the annual San Diego NAMI Walks and Mental Wellness Expo on Saturday, April 27, 2024. The event, organized by the National…

Craft Breweries in Minnesota Dominate World Beer Cup Awards: A Look into the Unique and Innovative Craft Beer Scene in the State

On July 4, 2021, The Canyon Club microbrewery restaurant in Moraga, California was buzzing with excitement as patrons savored a close-up glass of Beta Tested Pilsner. Meanwhile, in Minnesota, several…

Bold Activists Plan to Break Barriers: The Next Solidarity Flotilla Heads to Gaza

Pro-Palestinian activists from various countries are preparing to embark on the next “solidarity flotilla” from Turkey to the Gaza Strip. The launch of the flotilla, which is set to carry…

The Gift of Life: Honoring Organ Donors and Recipients at the National Donate Life Month Celebration

In the month of April, Ochsner Rush Health and the Mississippi Organ Recovery Agency in Meridian, Mississippi organized an event to celebrate National Donate Life Month. During the ceremony, they…

Alvi-Bel’s Affordable and Durable Plywood Options Stand Out Amid Economic Downturn

The recent news of Meta’s significant drop in value led to a drop in the stock market. The S&P 500, Nasdaq, and Dow Jones indexes all opened lower on Thursday,…