- Sat. Apr 27th, 2024

Latest Post

Gundersen Health System and Bellin Health Systems Explore Opportunities to Expand High-Quality Healthcare Services in the Chippewa Valley

Gundersen Health System is interested in exploring opportunities in the Chippewa Valley region to provide care as close to home as possible for the communities it serves. The healthcare system…

New Horizons in Chess: A Look at the Upcoming 2024 FIDE World Chess Championship Match and Hosting Opportunities

The FIDE World Chess Championship Match is the most prestigious event in the FIDE World Championship Cycle. The upcoming 2024 edition will determine the chess world champion for the next…

Rising Defense Budgets: A Global Phenomenon Driven by Changing Security Landscapes

The trend of increasing defense budgets has been on the rise for the past year, with European Union countries leading the charge. However, this trend is spreading globally, with countries…

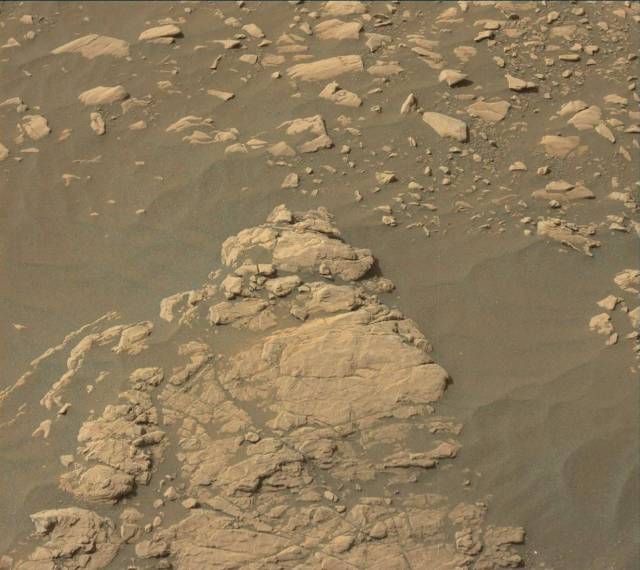

Unearthing the Past: The Race to Excavate Aberlady as NASA’s Next Potential Drilling Target on Mars

On Monday, our short drive brought two potential drill targets into clearer view. The prime candidate, known as “Aberlady,” displayed similarities in color, structure, and texture to the Sol 2365…

Exploring the Depths of Gale Crater: The Last Day on Highfield for Curiosity Rover

Last week, the Curiosity rover completed its final activities at the Highfield drill site. As the Surface Properties Scientist on duty, I noticed that there were no new tasks requiring…

Unraveling Martian Mysteries: The Quest for Potassium at Broad Cairn

The science team quickly set to work at “Hallaig,” six meters away from their initial location. Their investigation focused on a promising drill target known as “Broad Cairn,” located within…

The Fine Line Between Privacy and Public Safety: A Look at the Iowa Athletes’ Lawsuit Against Geolocation Tracking

A group of 26 athletes in Iowa has taken legal action against geolocation tracking that they believe violated their constitutional rights during an investigation into sports betting. According to ESPN.com,…

Curiosity’s Search for Suitable Drilling Sites on Mars: Sol 2256 and Beyond

The team was filled with excitement for Sol 2256 as they planned to reach out for contact science and drilling on Mars. However, they were faced with another setback when…

Sports Medicine Report: Preparing for Minnesota United FC on the Road without Jake Davis

The Sports Medicine Report on SportingKC.com provides the latest health update on the team before upcoming matches and is sponsored by Children’s Mercy Kansas City. This report comes from the…

Unraveling the Secrets of Mars: The Vera Rubin Ridge Mission Comes to a Close as We Celebrate New Year’s Eve on Earth

As the days lengthen and we approach the winter solstice on Earth, the Vera Rubin Ridge mission on Mars is nearing its end. On sol 2276, the team will analyze…