- Fri. Apr 26th, 2024

Latest Post

Romanian Court Rejects British Influencer Andrew Tate’s Appeals, Marking Beginning of Organized Human Trafficking Trial

A Romanian court has rejected British influencer Andrew Tate’s appeals on Friday, marking the beginning of his trial in the country for organized human trafficking and rape. No date has…

Akira Toriyama’s Posthumous Legacy: An Ode to the Creator of Iconic Video Game and Manga Characters.

Akira Toriyama, the creator of popular manga and video game characters such as those in “Chrono Trigger” and the “Dragon Quest” series, passed away at the age of 68. Despite…

Novant Health Enters the Municipal Bond Market to Secure $1.9 Billion in Funding Amid Financial Challenges for Healthcare Industry.

Novant Health, a North Carolina-based hospital system, has announced plans to enter the municipal bond market next week to secure $1.9 billion in funding. This move comes as the healthcare…

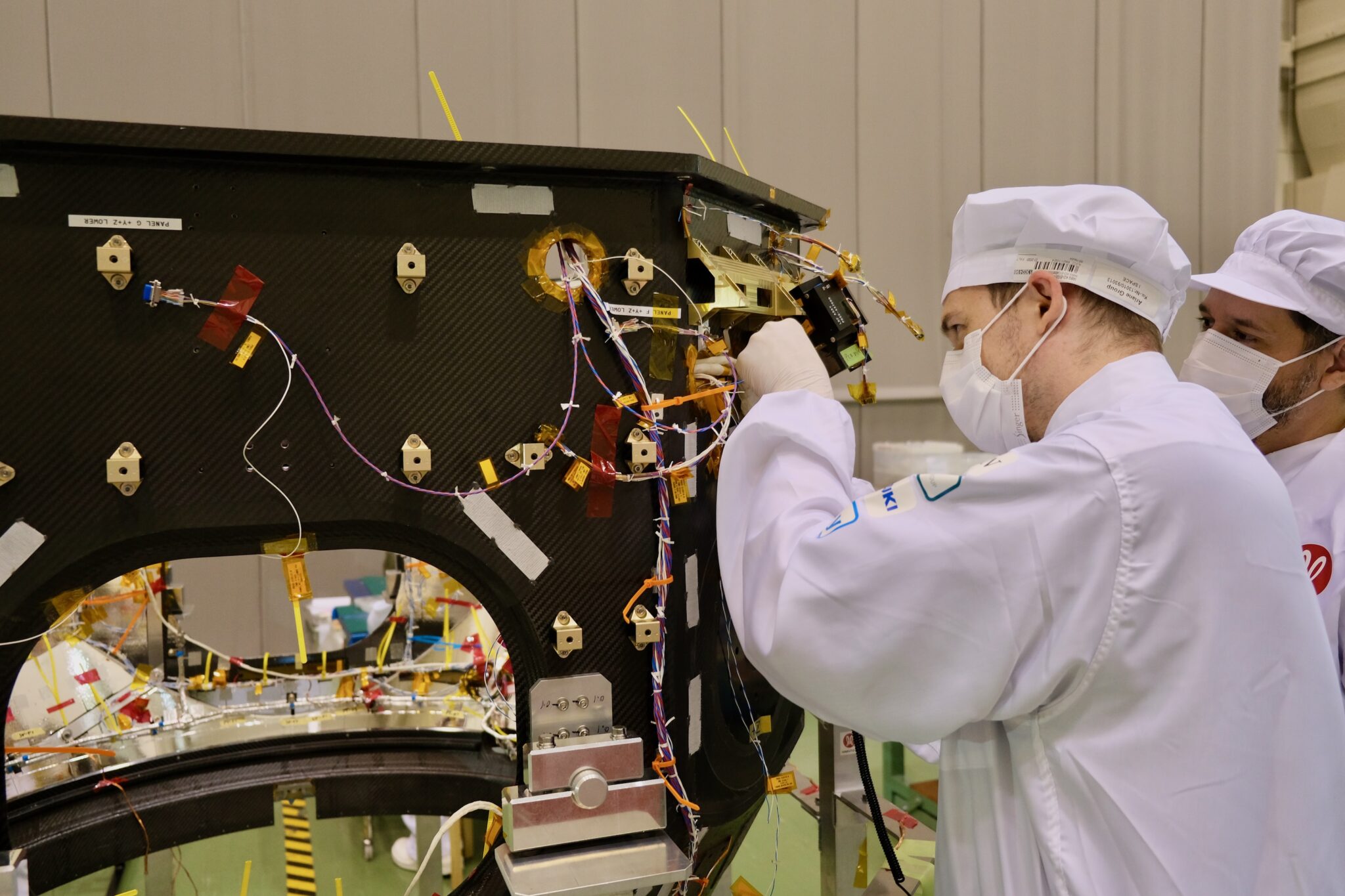

Japanese Moon Mission Makers, ispace, Unveil Communication System and Secure $45 Million Loan

In a major announcement at the 2024 Lunar Surface Innovation Consortium, ispace officially revealed its plans for a satellite communications system around the Moon. This came just after the company…

Navigating the Risks and Opportunities of Generative AI: How Internal Audit Teams Can Add Value

In today’s world, technology has become indispensable for organizations, playing a key role in almost every aspect of their operations. As new technology tools emerge, businesses are increasingly recognizing the…

NVIDIA’s latest acquisition of Israeli startup Run:AI for $700 million underscores its commitment to AI innovation and leadership. The purchase aligns with the company’s focus on real-time object detection and tracking, further strengthening its offerings in the autonomous vehicles and other applications space. NVIDIA’s recent acquisition of Deci, a startup specializing in AI technology optimization, is another example of its ongoing collaborations with leading companies in the field. By acquiring innovative startups, NVIDIA is positioning itself as a key player in the AI industry and driving advancements through strategic investments.

NVIDIA, a global leader in the development of chips for artificial intelligence (AI) technologies, recently announced the acquisition of Israeli startup Run:AI for $700 million. This purchase is part of…

Israeli Prime Minister Netanyahu: No Acceptance of International Criminal Court’s Authority on Israeli Defense

In a strongly worded statement on Friday, Prime Minister of Israel, Benjamin Netanyahu, made it clear that his government will never accept the authority of the International Criminal Court (ICC).…

eFootball™ Celebrates 750 Million Downloads with Special In-Game Events, Rewards, and Messi Cards

Konami Digital Entertainment BV has achieved a significant milestone with 750 million downloads of its football title eFootball™ globally. To celebrate this achievement, Konami has introduced a series of exciting…

Royal Health Update: Queen Elizabeth II’s Son Prince Charles’ Enlarged Prostate Treatment Ongoing, Doctors Optimistic

Buckingham Palace announced that Charles’ treatment for an enlarged prostate is ongoing, but doctors are optimistic about his recovery. The update came as a relief to the British public and…

Alleged Russian Manipulation: AfD’s Strategic Positioning and Negative View of Germany

A report by Spiegel claims that the Alternative for Germany (AfD) positions were formulated by strategists in Russia. According to the report, in September 2022, a department head at a…

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/SD5YTFVAKZGDDLDDPQ4RVTNBJE.jpg)