- Wed. Apr 24th, 2024

Latest Post

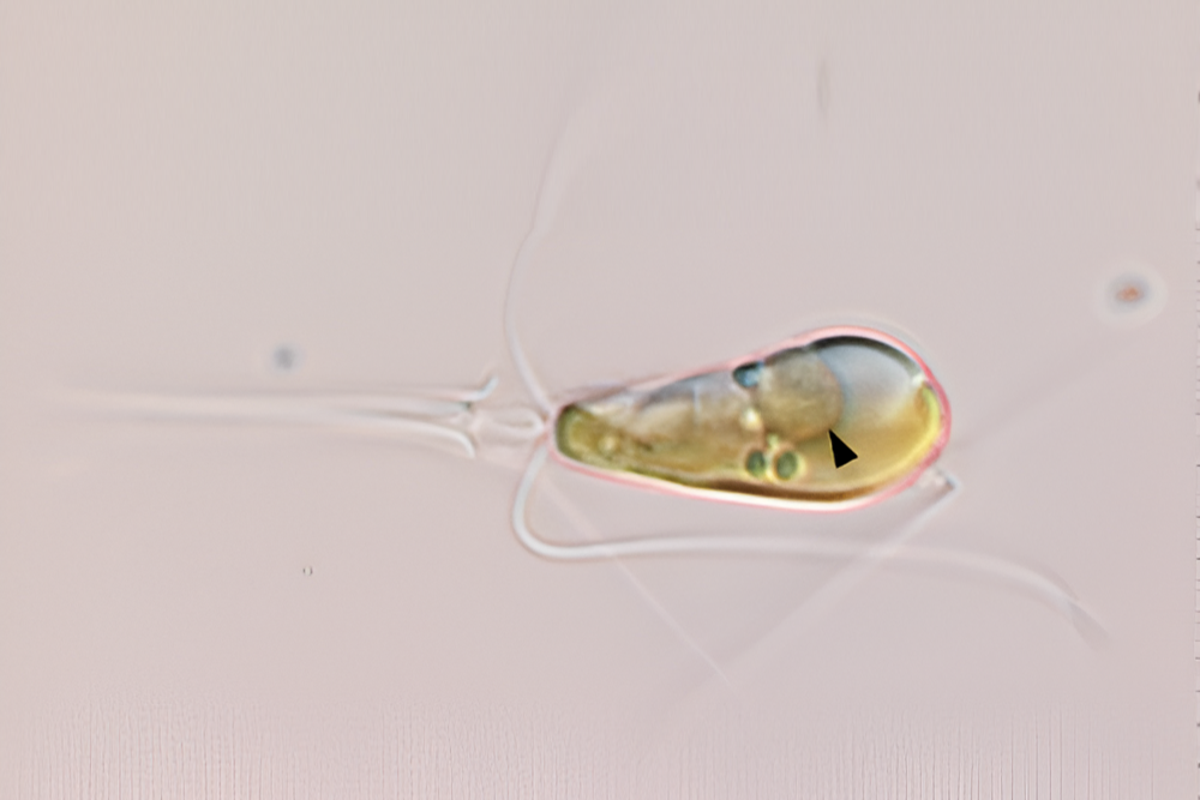

Unprecedented Evolutionary Breakthrough: Algae and Bacterium Merge to Form a New Organism through Primary Endosymbiosis

Receive a full digest of the best opinions of the week by subscribing to our Voices Dispatches email. You can also stay updated on all the latest insights by subscribing…

Investigation into Near-Drowning Incident at Six Flags Great Escape Lodge & Waterpark in Queensbury, New York

In response to a near-drowning incident at Six Flags Great Escape Lodge & Indoor Waterpark in Queensbury, New York, the New York State Department of Health is currently conducting an…

Accelerating Climate Action: World Sustainability Summit Takes Place in Dubai

The World Sustainability Summit is set to take place on April 25 and 26 at the Sustainable Institute building in The Sustainable City – Dubai. Hosted by the C Institute,…

INVL Technology: Undervalued, but with Growth Potential to Spare

INVL Technology, a closed-end investment company listed on the Nasdaq Vilnius stock exchange, had its 2023 financial results analyzed by Enlight Research. The report revealed that the company’s net asset…

Science Quencher: A Wild Adventure into the World of Conservation and Natural Resources

On April 26, from 5-7 p.m., the Whitefish Lake Institute will be hosting the Science Quencher event at The Lodge at Whitefish Lake. This engaging and informative event will feature…

Maximizing Tax Savings through Health FSAs: How to Use Funds Effectively in 2024

In 2024, individuals can contribute a maximum of $3,050 to a Health FSA, which reduces taxable income and can lead to tax savings. However, the Health FSA is a use-it-or-lose-it…

Navigating the Competitive Real Estate Market in Sioux Falls: Insights for Buyers, Sellers, and Realtors

Tea is experiencing rapid growth and expansion, with major developments such as a new multi-sport complex and road projects underway. This presents both opportunities and challenges for those looking to…

INVL Technology’s 2023 Financial Results Reveal 14% Growth and Historic Discounts in NAV Per Share

INVL Technology, an IT investment company, recently had its 2023 financial results analyzed by Enlight Research. The report revealed that the company’s net asset value (NAV) per share grew by…

Staying Informed: A Journalist’s Take on the Illinois Department of Health Infectious Disease Conference

In recent weeks, the Illinois Department of Health hosted its first infectious disease conference. The keynote speaker was Dr. Katelyn Jetelina, who emphasized the importance of sharing accurate information about…

Enlight Research’s Analysis: INVL Technology’s 2023 Financial Results and Portfolio Company Growth

Enlight Research has recently published an analysis of INVL Technology’s 2023 financial results. The company, which specializes in investing in IT businesses, saw an increase in its net asset value…