- Thu. Apr 18th, 2024

Latest Post

Finland’s Foreign Minister Urges Europe to Stand by Ukraine in Dire Situation: A Call for Increased Support

Finland’s Foreign Minister Timo Valtonen believes that Europe could do more to assist Ukraine as the situation in the country appears dire. With dwindling ammunition and troops, Ukraine lost Avdijvka…

Elite Interactive Solutions: 2024 Monitoring Technology Marvel Award Winner

The prestigious Monitoring Technology Marvel Award has been won by Elite Interactive Solutions in 2024. This award, co-sponsored by SSI and The Monitoring Association (TMA), recognizes professional monitoring centers and…

Phibro Animal Health Corporation Unveils Third Quarter Financial Results and Hosts Conference Call and Webcast

Phibro Animal Health Corporation (Nasdaq: PAHC) is set to reveal its third quarter financial results on Wednesday, May 8, 2024, after the market closes. Following this, Phibro management will host…

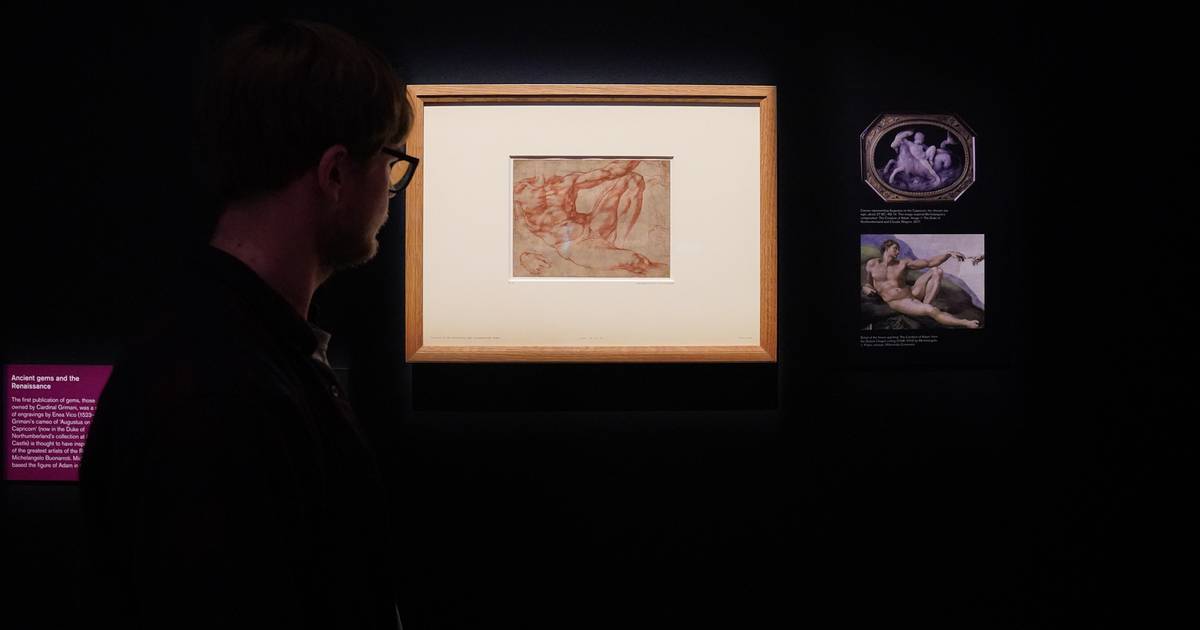

The Simile Drawing and Letter: A Rare Glimpse into Michelangelo’s Creative Process and Legacy Sold for Millions at Christie’s

A small drawing found on the back of a frame, accompanied by a letter from Michelangelo’s last direct descendant, was initially estimated to be worth between $6,000 and $8,000. However,…

Newman Regional Health Celebrates 300th Procedure with Da Vinci Robot-Assisted Surgical System

Newman Regional Health recently celebrated a milestone with its da Vinci Robot-Assisted Surgical System reaching its 300th procedure. Dr. Tim Harris, the surgeon responsible for both the first and 300th…

From Feathers to Flora: Tractor Supply Co. Hosts Exciting Events for Poultry Enthusiasts and Young Gardeners

Tractor Supply Co. at 72 Newton St. in Greenfield is hosting two exciting events on Saturday, April 20. The first event is a backyard poultry event that will run from…

Out-of-Network: The Shocking Reality of Limited Access to Behavioral Health Services and Solutions for Parity Violations

In a recent study conducted by RTI International, it was found that patients were significantly more likely to go out-of-network for behavioral health clinician visits in 2021. Specifically, they were…

California Maintains Fifth Largest Economy in the World for Seventh Year Running.

California maintained its position as the fifth largest economy in the world for the seventh year in a row in 2023, according to the International Monetary Fund’s (IMF) World Economic…

Swiss Parliament Votes to Ban Nazi and Extremist Symbols: What You Need to Know

The Swiss Parliament has recently passed an initiative that aims to ban Nazi, extremist, and racist symbols in the country. This follows the Swiss Senate’s vote in favor of the…

Battling for NBA Playoff Supremacy: The Milwaukee Bucks vs. the Indiana Pacers in a High-Scoring Showdown

The Milwaukee Bucks and the Indiana Pacers are set to face off in the first round of the playoffs, with game one taking place at Fiserv Forum on Sunday. Despite…