- Fri. Apr 26th, 2024

Latest Post

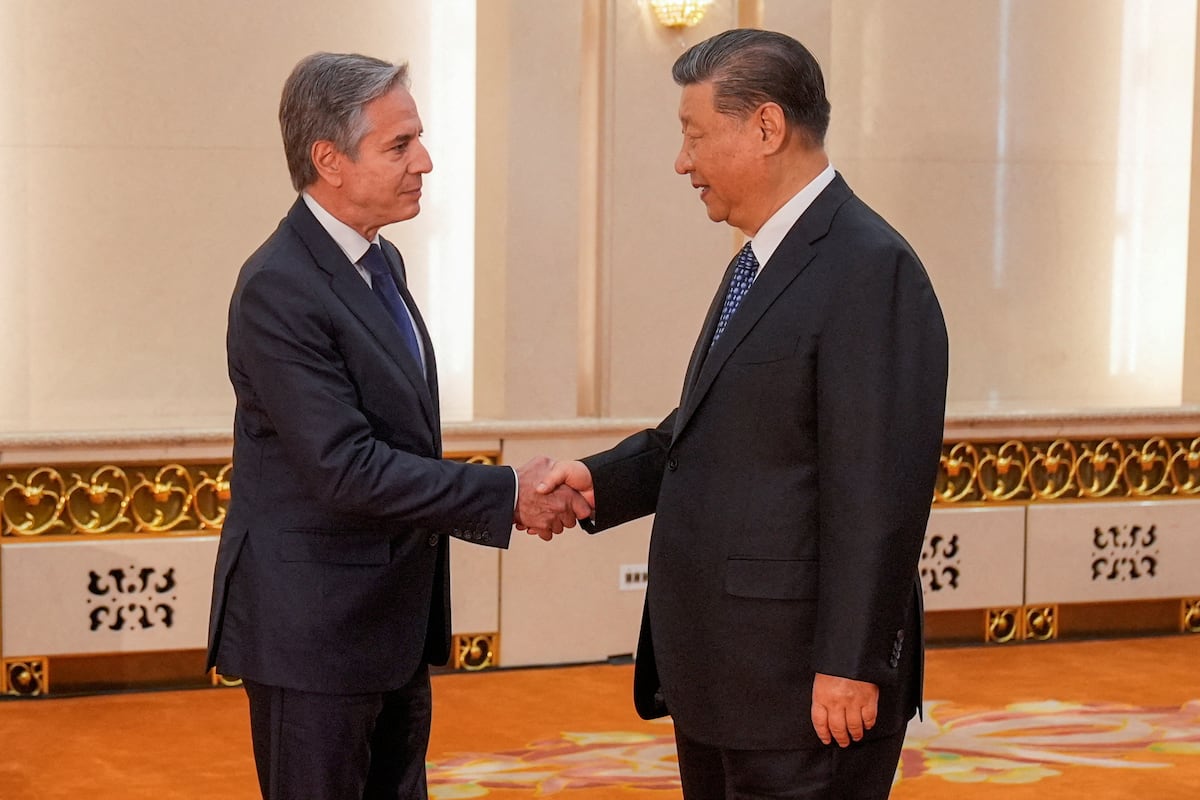

Diplomacy crucial for US-China relationship: Blinken emphasizes importance of active diplomacy during Beijing meeting

During his recent visit to China, US Secretary of State Antony Blinken emphasized the importance of active diplomacy in maintaining the fragile stabilization of bilateral ties. The need for cooperation…

Soothing an Upset Stomach: The Benefits of Gentle Exercise and Mindful Eating for Digestion

Reducing stress and engaging in gentle exercise like walking can help soothe an upset stomach and reduce bloating caused by overeating. Dr. Vu Truong Khanh, the Head of the Department…

SNB’s Monetary Policy: A Discussion on Stability, Special Interests and Politics

The General Meeting (AGM) of the Swiss National Bank (SNB) drew a lot of attention as attendees expressed their opinions on what changes the bank should make. However, Bank Council…

Leaking Personal Data: A Urgent Call for Accountability and Transparency in Argentina

In the past two weeks, Argentina has suffered a series of significant personal data leaks. First, a cybercriminal published over 115 thousand stolen photos from Renaper in early April. Two…

Ellen DeGeneres Opens Up About Mother’s Dementia and the Challenges of Balancing Public Image with Personal Struggles

Ellen shared that she is going through a difficult time, particularly due to her mother, Betty DeGeneres, suffering from dementia. She opened up about the challenges of caring for her…

Exploring the Wonders of Science: The Inland Empire Science Festival Returns!

The Inland Empire Science Festival held at the Western Science Center in Hemet was a huge success. Leya Collins, the WSC Museum Laboratory Manager, welcomed adults and youths attending the…

Amazon Sued for Market Manipulation, Sparking Debate on Antitrust Enforcement and Middle-Class Wealth

The Federal Trade Commission has recently filed a lawsuit against Amazon, accusing the company of engaging in illegal market behavior for years. Regulators are now pushing for accountability and demanding…

Shreveport Police Seek Public Assistance in Locating Missing Woman: Latonia Wade

In an effort to locate a missing 59-year-old woman, the Shreveport Police Department is seeking the public’s help. Latonia Wade was reported missing on April 3rd, 2024 and was last…

HHS Unveils New Federal Rule to Boost Civil Rights Protections for LGBTQ and Transgender Individuals

The Biden administration has introduced a new federal rule aimed at enhancing civil rights safeguards for transgender and LGBTQ individuals. This regulation, announced by the Department of Health and Human…

Regan Smith’s Olympic Dreams: From Stanford to the NCAA Portal, and Now with the Texas Longhorns

In March, Regan Smith made headlines when she entered the NCAA transfer portal. However, recent reports suggest that she has withdrawn from it. Athletes in the portal are classified as…